The Australian Taxpayers’ Alliance is urging major parties to implement family tax cuts, including joint tax filing and child tax exemptions, to help struggling families. Read more about our tax reform proposals.

Read MoreThe Australian Taxpayers’ Alliance (ATA), a grassroots advocacy group dedicated to protecting taxpayer rights and promoting government accountability, is voicing strong opposition against the Australian government's aggressive efforts to control online content. This initiative, spearheaded by the eSafety Commissioner, poses a severe threat to the principles of a free and open internet and risks setting a precedent that could inspire similar actions worldwide.

Read MoreProposed new laws from the Albanese Government on tobacco control have no credibility without serious measures to tackle the out-of-control black market for cigarettes operating in every town across the country, the Australian Taxpayers Alliance said today.

Read MoreAn “email generator portal” has created a shortcut for millions of Australians eager to speak out against a controversial government bill.

Read More“Poor economic analysis” could explain recent confusion around a round of income tax cuts set to benefit taxpayers earning more than $40,000 per annum.

Read MoreTax cuts across the board would help hard working Australians keep more of what they’ve earned - money they can use to cover the rising costs of living.

Read MoreStrangely, the new phone and seatbelt cameras are hidden, making them useless at preventing dangerous driving.

Read MoreThe four percent increase is the largest jump in 30 years and makes Australian beer drinkers the fourth most heavily taxed in the world.

Read MoreThe Australian Taxpayers’ Alliance outlined its top policy recommendations as a guide for federal election candidates in the lead up to the election. The recommendations aim to increase equality, decrease financial burdens in low-income households and reduce the number of people in the prison system by decriminalising victimless crimes.

Read MoreNew details have emerged outlining how Australia’s national debt will grow faster and larger, following the federal budget reveal. An Australian Taxpayers’ Alliance analysis paper explores how new avenues of wasteful spending resulted in a deficit $24 billion higher than necessary.

Read MoreNew modelling reveals Australia’s debt is growing at an increasing rate and is on track to trigger national bankruptcy by 2065. Based on current information, the debt model indicates the country’s total net debt will rise to match—and then surpass—GDP in 45 years.

Read MoreA hefty tax hike on beer sold in commercial venues has been dubbed a “death sentence” for small hospitality venues by advocacy group Australian Taxpayers’ Alliance. The price of a schooner in Australia is bound to rise as venues pass on the impacts of the increased tax to patrons. Already, around 42 per cent of the price of a beer is tax, leaving only a tiny portion to the venue.

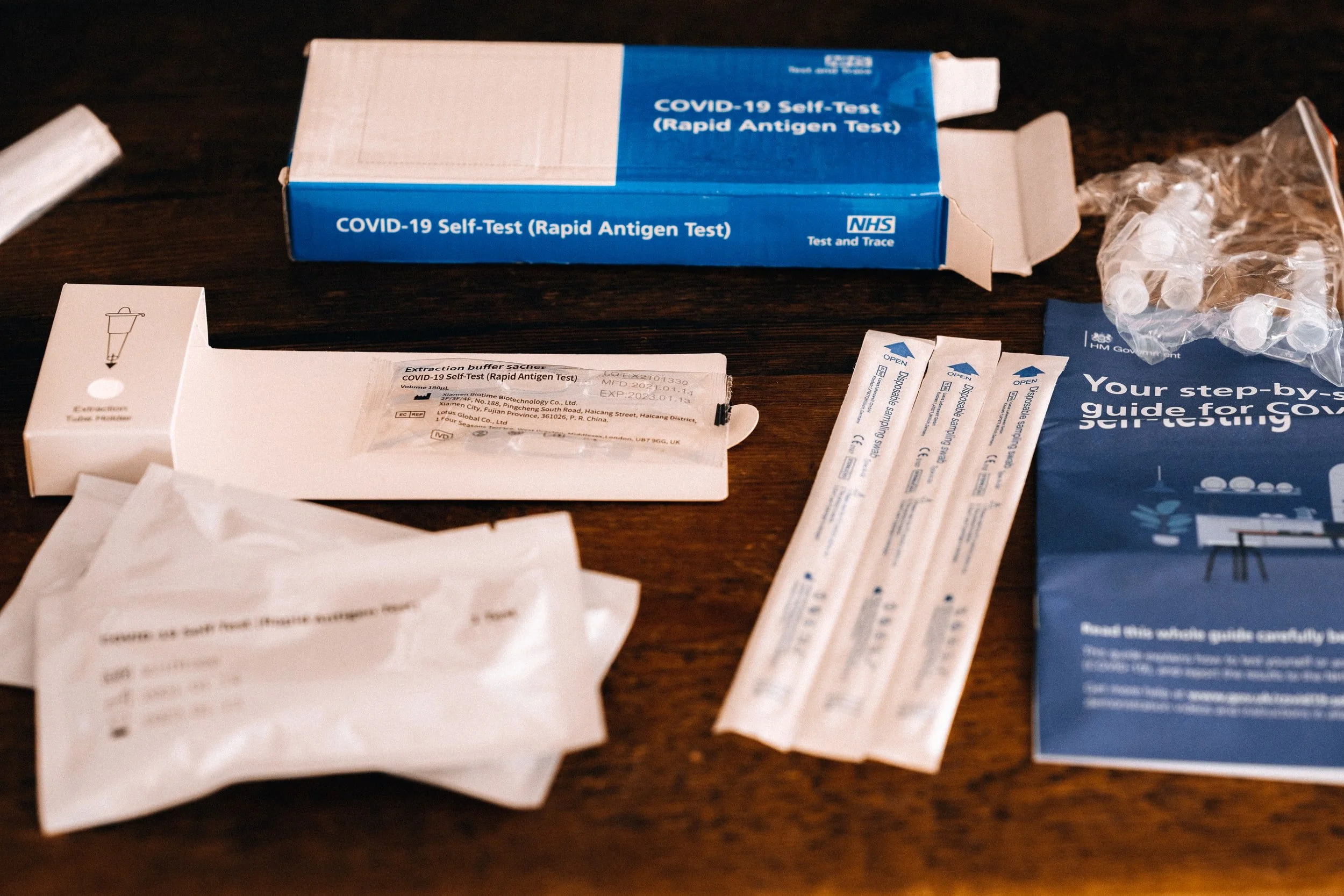

Read MoreDespite the good intention behind the idea, attempts to stop retailers from “price gouging” or raising the price of highly sought after Covid-19 RATs will only lead to a greater shortage of stock, exacerbate stockpiling and possibly create a black market.

Read MoreIt didn’t come as a shock to staff at the Australian Taxpayers’ Alliance to hear that fraudulent documents purporting to be Australian government-issued vaccination certificates were available for roughly the same price as a black-market carton of cigarettes.

Read More“The improvement in the economy would have shown improvement in the budget balance if the government had been able to control their addiction to new spending projects,” said Australian Taxpayers’ Alliance Chief Economist Dr John Humphreys.

Read MoreIt was with a sense of bewilderment that the Australian Taxpayers’ Alliance received the news this morning that Queensland Premier Annastacia Palaszczuk has announced that Chief Health Officer Jeanette Young would replace His Excellency The Honourable Paul de Jersey, AC, CVO, QC as Governor from November 2021.

Read MoreThe Australian Taxpayers’ Alliance (ATA) condemns Australian Prime Minister Scott Morrison’s recent strongman posturing on the proposed authoritarian expansions of police powers to invade the privacy of ordinary citizens.

Read More“This tax is nothing more than a revenue-raising exercise being pushed by bitter bureaucratic busybodies who should let Australians enjoy things for once,” said Brian Marlow, President of the ATA. “Time and time again we’ve seen how sin taxes like this fail wherever they’ve been implemented, yet the AMA seems to want to push these tired, broken tax models here in Australia.

Read More